|

Some Highlights:

As we usher in the new year, one thing is for certain… if you plan to buy or sell a house this year, you need a real estate professional on your team! There are many benefits to using a local professional! Pick a pro who knows your local market and can help you navigate the housing market!

0 Comments

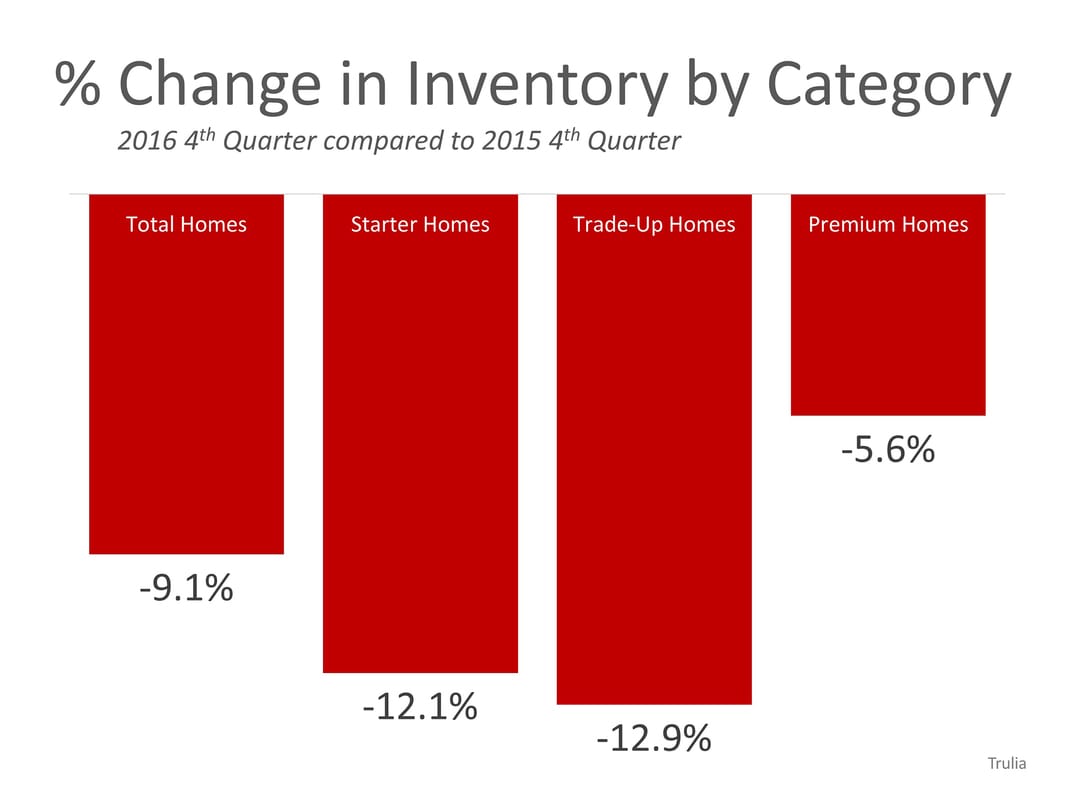

As we are about to bring in the New Year, families across the country will be deciding if this is the year that they will sell their current house and move into their dream home. Many will decide that it is smarter to wait until the spring “buyer’s market” to list their house. In the past, that might have made sense. However, this winter is not like recent years. The recent jump in mortgage rates has forced buyers off the fence and into the market, resulting in incredibly strong demand RIGHT NOW!! At the same time, inventory levels of homes for sale have dropped dramatically as compared to this time last year. Here is a chart showing the decrease in inventory levels by category: Bottom Line

Demand for your home is very strong right now while your competition (other homes for sale) is at a historically low level. If you are thinking of selling in 2017, now may be the time. When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal.

One great example of an agent who is in your corner and is always looking out for your best interests is one of the main characters on ABC’s Modern Family, Phil Dunphy. For those who aren’t familiar, the character Phil is a Realtor with a huge heart who always strives to do his best for his family and his clients. In one recent episode, Phil even shared the oath that he created and holds himself accountable to: "On my honor, I promise to aid in man's quest for shelter, to recognize I'm not just in the business of houses -- I'm in the business of dreams in the shape of houses. To disclose all illegal additions, shoddy construction, murders, and ghosts. And to put my clients' needs before my own." While this might seem silly, and it was definitely written with humor in mind, the themes of helping someone achieve the American Dream and putting a client's needs above your own are not to be taken lightly. Bottom Line When you make the decision to enter the housing market, as either a buyer or a seller, make sure you look for an agent who exemplifies these values and will help you through every step of the process. Some Highlights:

In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers.

Here are the top five reasons: 1. Exposure to Prospective BuyersRecent studies have shown that 94% of buyers search online for a home. That is in comparison to only 17% looking at print newspaper ads. Most real estate agents have an internet strategy to promote the sale of your home. Do you? 2. Results Come from the InternetWhere did buyers find the home they actually purchased?

3. There Are Too Many People to Negotiate WithHere is a list of some of the people with whom you must be prepared to negotiate if you decide to For Sale By Owner:

The 8% share represents the lowest recorded figure since NAR began collecting data in 1981. 5. You Net More Money When Using an AgentMany homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save the commission. Studies have shown that the typical house sold by the homeowner sells for $185,000, while the typical house sold by an agent sells for $245,000. This doesn’t mean that an agent can get $60,000 more for your home, as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense. Bottom Line Before you decide to take on the challenges of selling your house on your own, let’s get together and discuss the options available in your market today. According to a Merrill Lynch study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement.

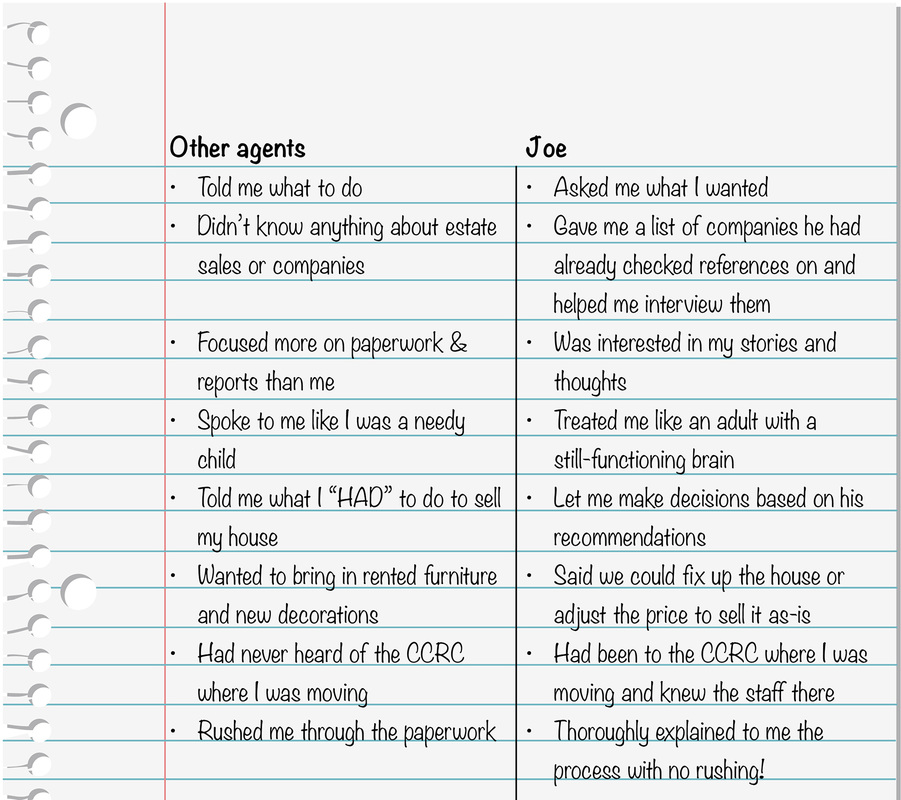

As one participant in the study stated: “In retirement, you have the chance to live anywhere you want. Or you can just stay where you are. There hasn’t been another time in life when we’ve had that kind of freedom.” The top reason to relocate cited was “wanting to be closer to family” at 29%, a close second was “wanting to reduce home expenses”at 26%. A recent Freddie Mac study found similar results, as “nearly 20 percent of Boomers said they would move closer to their grandchildren/children compared to 13 percent who said they would move to a warmer climate.” Not Every Baby Boomer Downsizes There is a common misconception that as retirees find themselves with fewer children at home, they will instantly desire a smaller home to maintain. While that may be the case for half of those surveyed, the study found that three in ten decide to actually upsize to a larger home. Some choose to buy a home in a desirable destination with extra space for large family vacations, reunions, extended visits, or to allow other family members to move in with them. According to Merrill Lynch: "Retirees often find their homes become places for family to come together and reconnect, particularly during holidays or summer vacations." Bottom Line If your housing needs have changed, or are about to change, let’s get together to discuss your next steps. Jay Buinicky, Realtor, Senior Real Estate Specialist 704-900-3218 Today we are pleased to have Nikki Buckelew back as our guest blogger. Nikki is considered a leading authority on seniors real estate and housing. Enjoy! It was her 80th birthday and as Sue's family gathered around in celebration, she announced a major decision. After years of toying with the idea, she had come to the conclusion that now - yes, now - was the proper time for her to move into a continuing care retirement community (CCRC). Although they were a bit surprised, Sue's two adult children (both seniors themselves) nodded to each other and expressed relief that their mother would have access to the support and care she needed. Both admitted to a bit of worry about her living alone since their dad died, especially as they both traveled extensively and were not available to see her or care for her on a regular basis. But, of course, they all realized that such a move would require a massive commitment of time and energy, with the first necessary step being to find a good real estate agent to help sell the longtime family home. Sue mentioned that she was acquainted with an agent she had met at church and who regularly sent her mailings. The agent seemed quite nice and professional, had won numerous awards, was active in the community, and owned a variety of impressive-looking credentials. You know, she had a whole bunch of letters and acronyms at the end of her name. Sue and her children arranged for a meeting with the agent, and while she was clearly competent and well-educated in her field, Sue just couldn't get past a nagging feeling that something was amiss. The agent was nice enough, but throughout Sue's entire life, she had tended to gravitate toward doing business only with those to whom she felt some sort of connection. Perhaps it was something she had learned from her father, a man who valued relationships in business dealings as much or more than mere competence. Not only did she want help, but she also wanted to feel a special sort of bond and trust. The practice had served her well throughout life and now - with such an important transaction - she wasn't about to change her approach. Sue scanned the yellow pages, spoke on the phone with a few agents, and even met with another over coffee, but still she couldn't find the sensation of trust and comfort she desired. She even did a couple of quick internet searches leaving her feeling confused and frustrated. It occurred to Sue's daughter that perhaps the CCRC that was to be Sue's new home would be able to provide a recommendation for a good agent. Indeed, they did, and that's when she met Joe. Joe was different He arrived at her home and immediately the two hit it off. Sue hired Joe to list and sell her house and as he began to take his leave, Sue touched him gently on the arm and said "Thank you, Joe. You are different than other agents I've met with," she smiled. "I don't know exactly what it is, but I feel I can truly trust you to help me make this move." Sue's home sold quickly, and with Joe's help, she arranged for an estate liquidator to sell the belongings she no longer needed. He also arranged for a moving company to pack and transport what was needed to Sue's new apartment at the retirement community, and made sure she was content in her new home. A few days later, Sue's children visited their mother, breathed a sigh of relief that everything seemed under control, that a large project was complete and that - most importantly - Mom was happy, healthy, and safe. Her daughter (who admittedly had been a bit annoyed at Sue's "pickiness" in choosing an agent) smiled and remarked that Sue had made a fine decision in choosing Joe to spearhead the sale and move. "But Mom," Sue's son asked. "How did you make your decision? Why did you choose him?" Sue dug into her purse and drew out the list of notes she had made while interviewing Joe: As her daughters looked at the list, Sue remarked "I felt 'OK' with the other agents. They were undoubtedly good at their jobs. But I wanted someone who was good for ME too."

And thus ends the happy story of Sue, a senior whose outlook on doing business mirrors that of most of her generation, nearly all of whom value a firm handshake and "good vibes" as much as they do hard numbers and competency. Bottom Line As real estate professionals serving seniors, it's important that we understand that what makes for a great partnership, truly is in the eyes of our clients. In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search.

If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television orPinterest, and start looking at the countless homes listed for sale with rose-colored glasses. Do you really need that farmhouse sink in the kitchen in order to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the man cave of your dreams be a future renovation project instead of a make or break now? The first step in your home buying process should be to get pre-approved for your mortgage. This allows you to know your budget before you fall in love with a home that is way outside of it. The next step is to list all the features of a home that you would like, and to qualify them as follows:

Bottom Line Having this list flushed out before starting your search will save you time and frustration, while also letting your agent know what features are most important to you before starting to show you houses in your desired area. School is back in session, the holidays are right around the corner, you might not think that now is the best time to sell your house. But with inventory below historic numbers and demand still strong, you could be missing out on a great opportunity for your family.

Here are five reasons why you should consider selling your house this fall: 1. Demand Is StrongThe latest Realtors’ Confidence Index from the National Association of Realtors (NAR) shows that buyer demand remains very strong throughout the vast majority of the country. These buyers are ready, willing and able to purchase… and are in the market right now! Take advantage of the buyer activity currently in the market. 2. There Is Less Competition NowAccording to NAR’s latest Existing Home Sales Report, the supply of homes for sale is still under the 6-month supply that is needed for a normal housing market at 4.7-months. This means, in most areas, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices. However, additional inventory is about to come to market. There is a pent-up desire for many homeowners to move, as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last two years. Many of these homes will be coming to the market this fall. Also, as builders regain confidence in the market, new construction of single-family homes is projected to continue to increase over the next two years, reaching historic levels by 2017. Last month’s new home sales numbers show that many buyers who have not been able to find their dream home within the existing inventory have turned to new construction to fulfill their needs. The choices buyers have will continue to increase. Don’t wait until all this other inventory of homes comes to market before you sell. 3. The Process Will Be QuickerFannie Mae announced that they anticipate an acceleration in home sales that will surpass 2007's pace. As the market heats up, banks will be inundated with loan inquiries causing closing-time lines to lengthen. Selling now will make the process quicker & simpler. 4. There Will Never Be a Better Time to Move UpIf you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by 5.3% over the next year, according to CoreLogic. If you are moving to a higher-priced home, it will wind up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. According to Freddie Mac’s latest report, you can also lock-in your 30-year housing expense with an interest rate around 3.46% right now. Interest rates are projected to increase moderately over the next 12 months. Even a small increase in rate will have a big impact on your housing cost. 5. It’s Time to Move On with Your LifeLook at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should? Only you know the answers to the questions above. You have the power to take control of the situation by putting your home on the market. Perhaps the time has come for you and your family to move on and start living the life you desire. That is what is truly important. |

RSS Feed

RSS Feed